Here’s A Quick Way To Solve A Info About How To Become A Millionaire By 65

If you have not saved anything at the age of 40, you will need $1,270 monthly at 7% yield (calculating inflation at 3%) to reach your goal at age 65 of $1,000,000.

How to become a millionaire by 65. The two most common types of retirement accounts are iras, which are personal accounts, and 401 (k)s, which are. The above figures assume savers increase contributions. How to become a millionaire in your 60s consider having an advisor.

How to become a millionaire by 65 step 1: Finding the right financial advisor who can help you get a full financial picture can be. Investing your money is how to become a millionaire fast.

How to become a millionaire by 65 home investments how to become a millionaire by 65. The table below shows how much millennials need to start saving per month to become an isa millionaire by the time they are 65. Take a moment to think about the lifestyle you’d like to have.

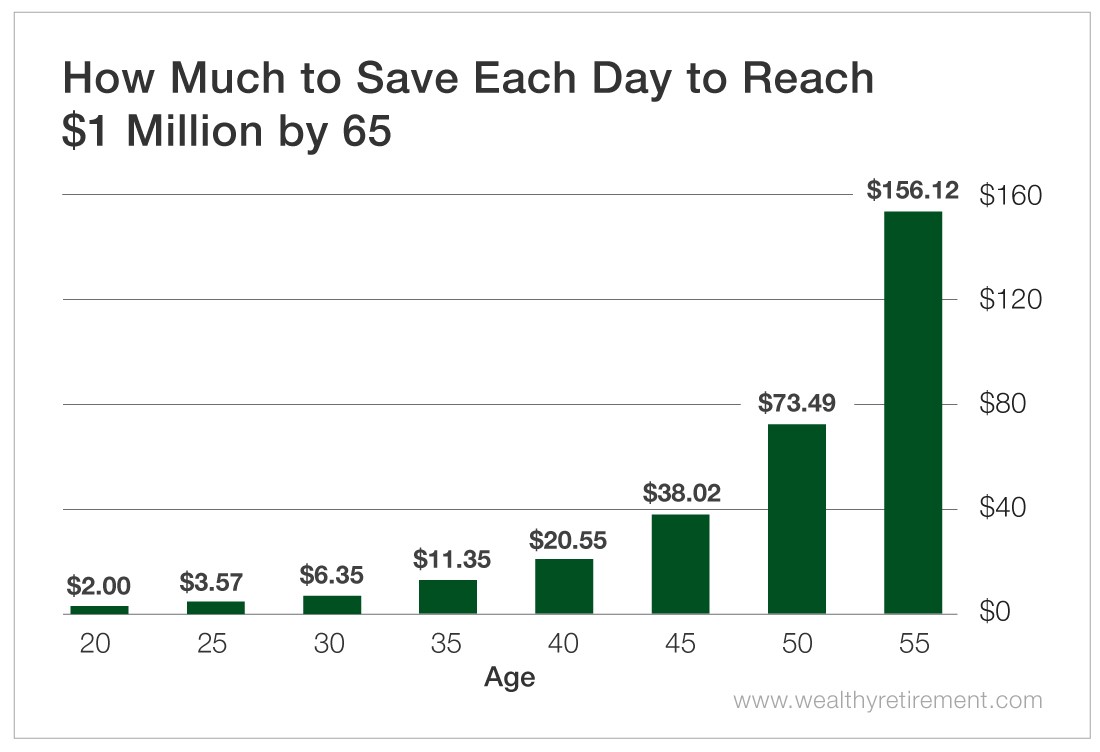

Believe it or not, that can get you to be a millionaire by the time. If you were to start investing for a 9% yearly return just five years earlier at age 40, you would need to contribute $950 per month to reach $1 million by age 65. How much to save per day to retire a millionaire by 65 the real no bull**** way of how much you need to save per day to retire a millionaire by the time you.

It might seem impossible, but you can start off by saving just $2 a day when you’re 20 or $20.55 when you are 40. If you instead started five years earlier at the age of 25, your roth ira would be worth $1.5million by the time you hit 65. It outlined the importance of investing and how much you need to put away in savings to become a millionaire by the time you’re 65.